There’s so many options available for the business owner who wants to take care of their own books. For some users, it’s a matter of price while others look more toward functionality and integrations.

There’s so many options available for the business owner who wants to take care of their own books. For some users, it’s a matter of price while others look more toward functionality and integrations.

I think it’s important to look at it all, especially what you need within your own business. Because no two businesses are created equal.

Let’s take a look at the difference between Wave and QBO, and you can decide which is the best bet for you. (Can you guess which is my go-to pick?)

Pricing

I know a lot of business owners are price-shoppers. While I don’t blame you, it’s important to still do your research. I believe you get what you pay for, which means that “free” isn’t always the best bet if you’re looking to cut costs. It just might cost you more in the long run if it doesn’t offer all the features you ultimately need.

- QBO: Three pricing plans, depending on the features you need, starting at $10 a month

- Wave: Free, with additional paid services for payroll and online payments

[bctt tweet=”I know a lot of business owners are price-shoppers. While I don’t blame you, it’s important to still do your research. ” username=”NNBSolutions”]

Integrations

How well does your bookkeeping software “talk” to other systems? In today’s ultra-connected world, your systems need to speak to one another to be more efficient–saving you time and money and ensuring that human error isn’t part of the equation.

- QBO: 1,000+ with both Zapier and stand-alone integrations

- Wave: Three – Etsy, Shoeboxed and Paypal only

Security

You’re dealing with bank feeds and log-ins that needs to be secure. Having something you can depend on, without the risk of your sensitive information falling into the wrong hands, is important.

- QBO: Data encryption, backups and physical security

- Wave: Data encryption, backups and physical security

Setup

This is the most important step, besides making sure the accounting program has all the features that you need based on your business type. If the program isn’t set up right from the beginning it will affect the accuracy of the data on your reports.

- QBO: Setup in QBO is intense but straightforward if you watch the training and setup videos or have a professional help you. Expect to spend anywhere from 1 to 3 hours setting up QBO the first time. Another option is to have a professional set up your file. Then, purchase a block of training hours for particulars in the beginning.

- Wave: Easier setup than QBO but still a learning curve. It might be best for a professional to help you set it up and give you some training. It will take roughly 1 to 2 hours for setup depending on the level of detail in how want to categorize your income and expenses. Wave has a great help section of webinars, videos, and guides.

Accounting

I recently wrote about cash vs. accrual accounting, a distinction that’s important for small business owners. Because many small businesses start with cash accounting, it’s important to have that option in your bookkeeping and accounting software. Only one of these systems does.

- QBO: Offers both cash- and accrual accounting options plus a slew of reports

- Wave: Only allows for accrual accounting

Reports & Features

Every business is different and a bookkeeping system should be able to grow with it. While you may not use all the features of a robust system early on, having access to inventory control, budgeting and tax support options is helpful as your business grows and matures.

- QBO: Offers the above features, plus up to 75 different reports

- Wave: Has 12 available reports, which are basic reports in QBO

- QBO: Has an inventory option, category tracking and budgeting

- Wave: Does not offer inventory, category tracking or budgeting

- QBO: Has a reconciliation feature

- Wave: Does not have a reconciliation feature

- QBO: Can exclude transaction(s) but, not delete them

- Wave: Can exclude + delete transaction(s)

[bctt tweet=”Every business is different and a bookkeeping system should be able to grow with it. ” username=”NNBSolutions”]

If you are planning on hiring a bookkeeper anytime soon you’ll want to do some research and find someone that works with the accounting system you’ve chosen, for both bookkeeping and training needs you might have. Find one to three professionals and schedule a free introductory call with them to discuss your options, what you are considering and why. They’ll also give you valuable information to consider in your decision making process as well. Keep in mind, professionals are biased as we are typically used to using certain programs and have our favorites. Here at Number Nerd we use a variety of programs for clients for various reasons. Feel free to schedule an introductory call with a Number Nerd professional to discuss your software options based on your business type.

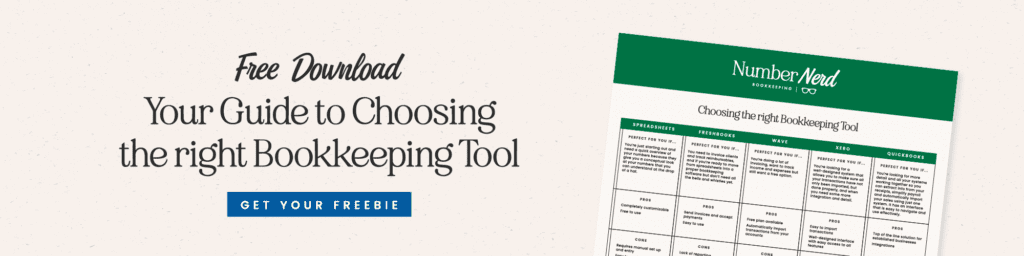

I’m sure it’s so secret that QBO has long been my go-to favorite bookkeeping system for any client. It just makes sense to have the most streamlined options, and at a reasonable cost. Here’s a Wave comparison chart to the various versions of QuickBooks Online. Other things to consider when choosing a system is the learning curve and trainings available. And as you grow, you’ll want to know the best way to transition from one system to another. Of course, I think QBO is powerful enough to use with nearly any size business.